Gifts That Cost You Nothing Now

Gifts in a will or by beneficiary designation are two easy ways to open up a world of opportunity for future Georgia State students, giving them the skills and opportunities they need to achieve great things. You can provide all Panthers an excellent education and exceptional support for years to come — and it won’t cost anything now.

If you have already included a gift in your estate plans to benefit the future of Georgia State University, be sure to let us know so that we may best honor your wishes.

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting positive impact on Georgia State University. Once you have provided for your loved ones, we hope you will consider supporting this enterprising public university through a legacy gift.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

LASTING IMPACT

Your gift will add to your legacy the enduring support of Georgia State students for years to come.

FLEXIBLE

You can alter your gift or change your mind at any time and for any reason.

NO COST

Costs you nothing now to give in this way.

Four simple, “no cost now” ways to give in your will

General Gift – A general bequest is a gift of a specific amount.

Residuary Gift – A residuary gift is a gift of all or a percentage of the remainder of your estate after specific bequests and expenses have been paid.

Specific Gift – A specific gift is a gift of a particular piece of property. For example, real estate, funds in a bank account or shares of a corporation.

Contingent Gift – A contingent gift takes effect only if the primary beneficiary or beneficiaries do not live longer than you. In other words, your gift is contingent upon whether or not they survive after you.

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to the Georgia State University Foundation or your local council contingent upon the survival of your spouse.

Gifts by Beneficiary Designation

It’s easy to put to use your bank accounts, retirement funds, savings bonds and more to transform the lives of future Panthers — and it costs you nothing now.

By naming the Georgia State University Foundation as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of providing all students an outstanding education, uncommon support and exceptional opportunities.

Potential benefits of gifts by beneficiary designation:

Reduce or eliminate taxes

Reduce or avoid probate fees

No cost to you now

Create a legacy with Georgia State University

Types of Gifts

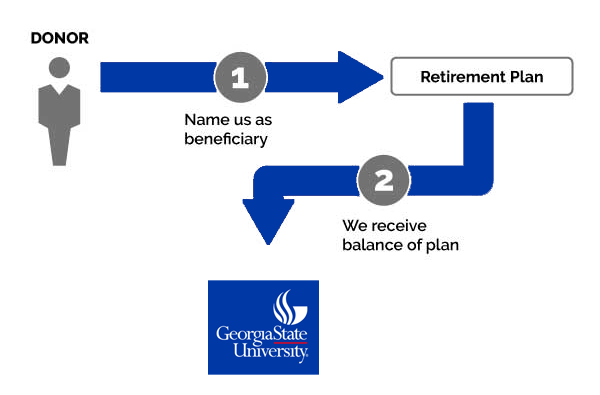

Retirement plan assets

You can simply name the Georgia State University Foundation as a beneficiary of your retirement plan. When you do, you support the future of this enterprising public research university so that it can continue transforming lives, advancing the frontiers of knowledge and strengthening the workforce of the future.

Life insurance policies

You can name the Georgia State University Foundation as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, Georgia State will receive the proceeds of your policy after your lifetime. This may reduce your estate taxes and you can change your beneficiary at any time.

Bank or brokerage accounts

This is one of the easiest gifts to give and one of the most useful for accomplishing your philanthropic goals. The next time you visit your bank, you can name the Georgia State University Foundation, Inc. (Tax ID: 58-6033185) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD) or a brokerage account. When you do, you’ll take a powerful step toward transforming the lives of Georgia State students for generations to come.

Funds remaining in your donor-advised fund

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name the Georgia State University Foundation as a “successor” of your account or a portion of your account value, you enable educational opportunities for tens of thousands of students from all backgrounds at the graduate, baccalaureate, associate and certificate levels.

How to update a beneficiary designation:

Simply contact your bank, retirement plan administrator, insurance company or other financial institution to request a beneficiary designation form. You may also be able to log in to your account and update your beneficiaries online.

Please use our legal name: Georgia State University Foundation, Inc.

Include our tax identification number: 58-6033185

Please let us know so we can ensure that your wishes are carried out.